Austin and Round Rock buyers had more choices than ever in the November housing market, with a considerable jump in active listings, new listings, and pending listings, according to the Austin Board of REALTORS® November 2023 Central Texas Housing Market Report. The local housing supply has also become more readily available to the public at lower price points, with an 8.4 percent drop in the median home price to $424,450 last month. Homes are still sitting on the market for an average of 75 days, which is up 18 days from the previous year. Housing inventory has increased, however, from 3.0 months to 3.7 months. New listings rose 11.6 percent to 2,676 listings, active listings increased 7.2 percent to 9,334, and pending listings jumped 9.2 percent to 2,065 listings.

“Buyers in Central Texas now have a more abundant selection of homes to peruse than in previous years,” Ashley Jackson, 2023 ABoR president, said. “The drop in median home prices indicates buyers can be a little more selective in the search for a home that checks all their boxes. For buyers actively shopping for a home—and those who have been sitting on the fence waiting for their time to strike—now is the time to contact your REALTOR® and get serious about buying a home.”

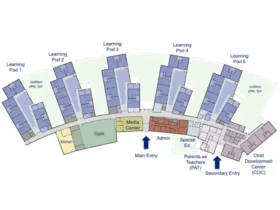

The Home Options For Middle-Income Empowerment Initiative

The Austin City Council has officially passed the first phase of this exciting initiative designed to create more affordable opportunities for homeownership and renters in the Austin area! The Austin Board Of Realtors® continues to advocate for affordable housing options, and Dr. Losey shared some encouraging news about how the market will look in the new year.

“The year-over-year uptick in new and active listings provides buyers with more options, which is a welcome reprieve from the starved market many have endured in recent years. While this current increase in listings gives our market some breathing room, our city should embrace opportunities to generate more housing supply.”

A Look At Mortgage Rates

Rising mortgage rates have been one of the most significant factors in a slowing market.

Clare Losey, Ph.D., housing economist for ABoR, spoke on the peaking rates and how they have contributed to declining home prices, increasing listings, and days on the market statistics.

“A rise in mortgage rates reduces buyers’ purchasing power, so the moderation in home prices helped to offset some of the decline in affordability. However, rates peaked in late October and early November, signaling a rise in buyers’ purchasing power moving into 2024,” she says.