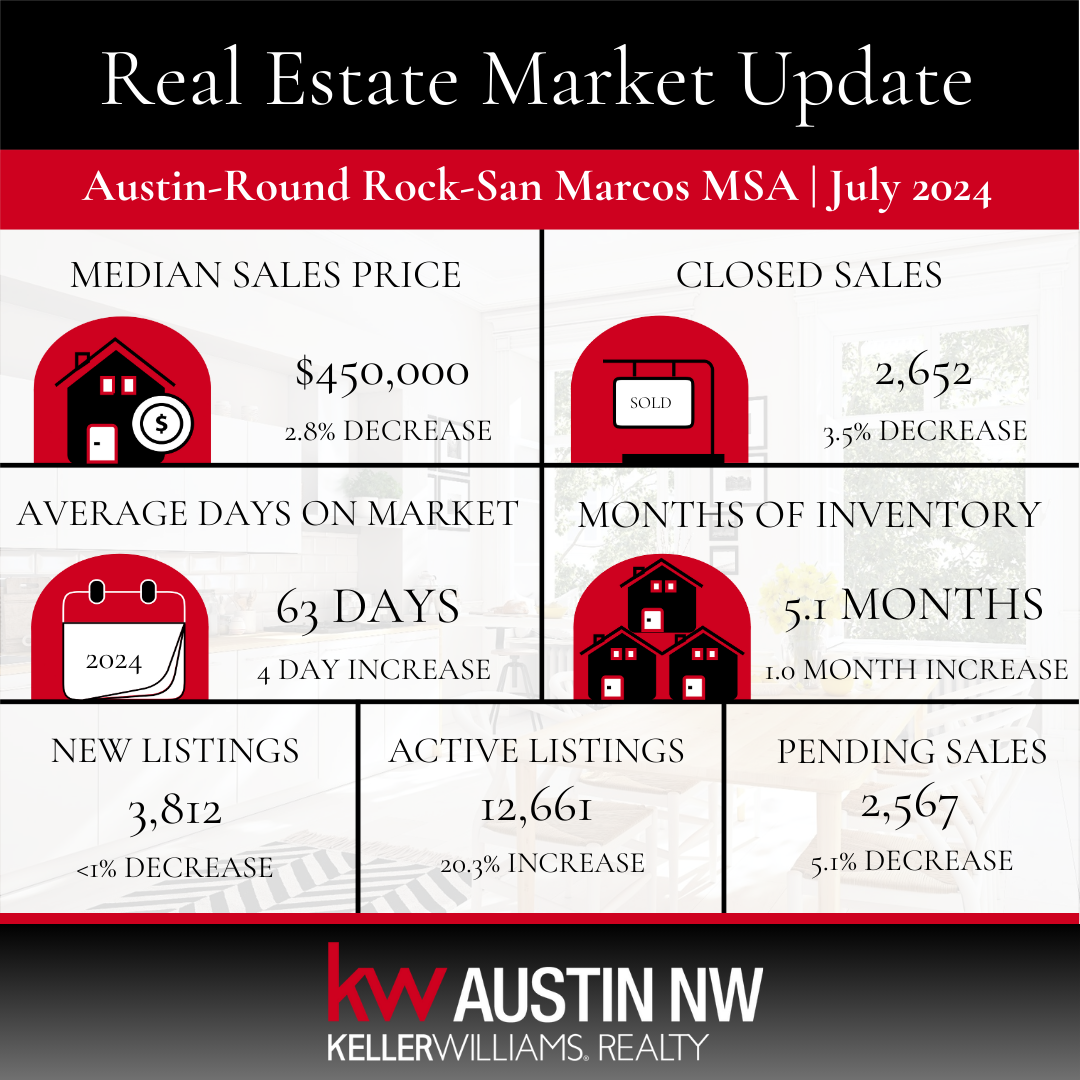

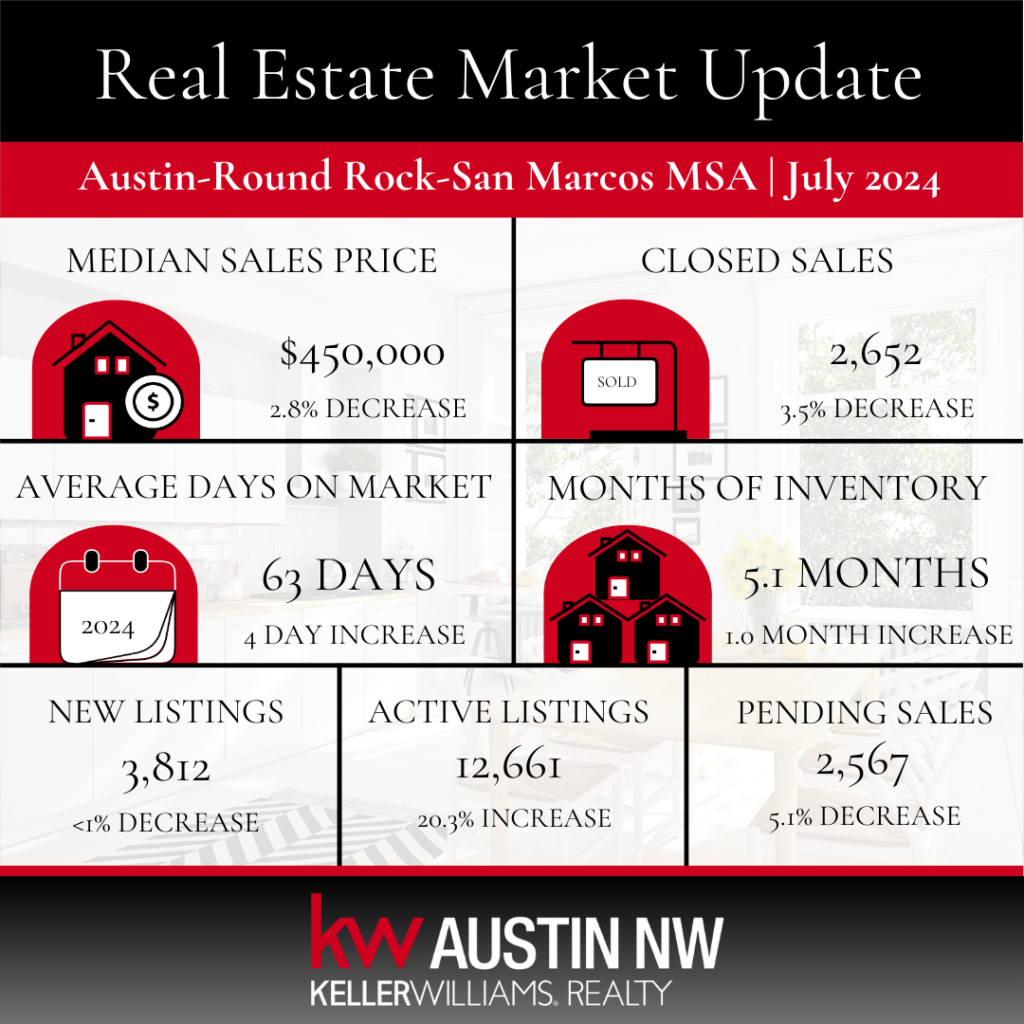

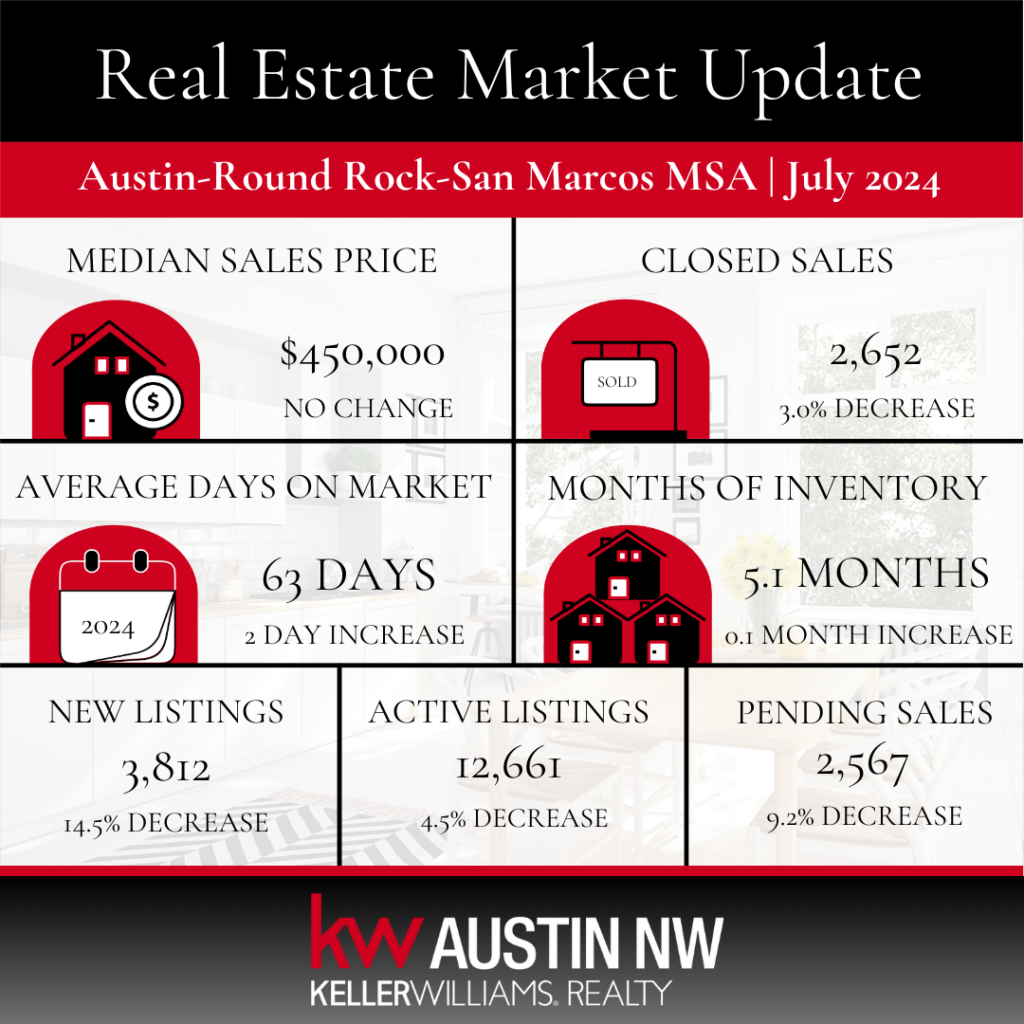

The median sales price in the Austin-Round Rock-San Marcos MSA decreased by 2.8% to $450,000, while closed sales decreased by 3.5% compared to the same time in 2023. Notably, sales increased in Williamson, Hays, Bastrop, and Caldwell counties, indicating that buyers are seeking more affordable housing options outside of the metro area. Average days on market came in at 63 days, a 4-day increase, while months of inventory also rose to 5.1 months.

Mortgage rates remain elevated, and this is strongly influencing the purchasing power of buyers. Still, the accelerating number of closed sales in bordering counties like Williamson County indicates the strength of housing demand, and we continue to see this strength demonstrated in Leander neighborhoods when properties are properly prepared for the market, priced right, and presented well.

“Consistently high mortgage rates continue to impact buyer’s purchasing power, but July’s increase in sales in four of the five MSA counties shows the strength of Central Texas housing demand,” Clare Knapp, Ph.D, housing economist for Unlock MLS and the Austin Board of REALTORS®, said.

“With rates around 6.5%, only about half of homeowners in our market can afford a median priced home and only about a quarter of renters can afford a starter home,” she continued. “Home prices across the market still need to decrease to meet market conditions and meet buyers where their purchasing power is currently. It is notable that we are seeing more first-time buyers willing to make a move this year compared to last, and that is a positive sign for our market.”

Let’s dive into the raw data.

Year-Over-Year Market Statistics for Austin-Round Rock-San Marcos for July 2024:

Month-Over-Month Market Statistics for Austin-Round Rock-San Marcos for July 2024:

Year-Over-Year Market Statistics for Williamson County for July 2024:

Analysis

What does all this mean (in layman’s terms) if you plan to make a move this year?

For Sellers:

What does this mean if you plan to sell your home this fall? Pricing continues to soften slightly, but equity positions remain strong. It is essential to work with an experienced real estate professional who understands the importance of property preparation, pricing, and presentation (the 3 Ps). Hire an agent who is an expert negotiator, is immersed in the local market, understands your financial goals and needs, and knows your neighborhood and general area very well.

For Buyers:

What does this mean if you plan to buy a home this fall? Your selection of home choices continues to grow, which means you can take your time to find a property that is truly right for you. You’ll discover some sellers are more willing to negotiate to make the deal a win-win for everyone. Keep in mind that you’ll want to hire an agent to advocate on your behalf only (a fiduciary), and you’ll also want to hire an experienced mortgage professional if you plan on obtaining a loan for your purchase.

Making A Move This Fall?

There are a number of ways a seasoned and experienced agent can negotiate on behalf of their seller clients and their buyer clients, and we are tireless when it comes to working for you. A home is often the largest investment you’ll make, so it’s essential to work with a fiduciary who prioritizes your interests above all else. We take this responsibility seriously and are committed to protecting your interests every step of the way. If we can help guide you home, contact The Cummings Team® today!