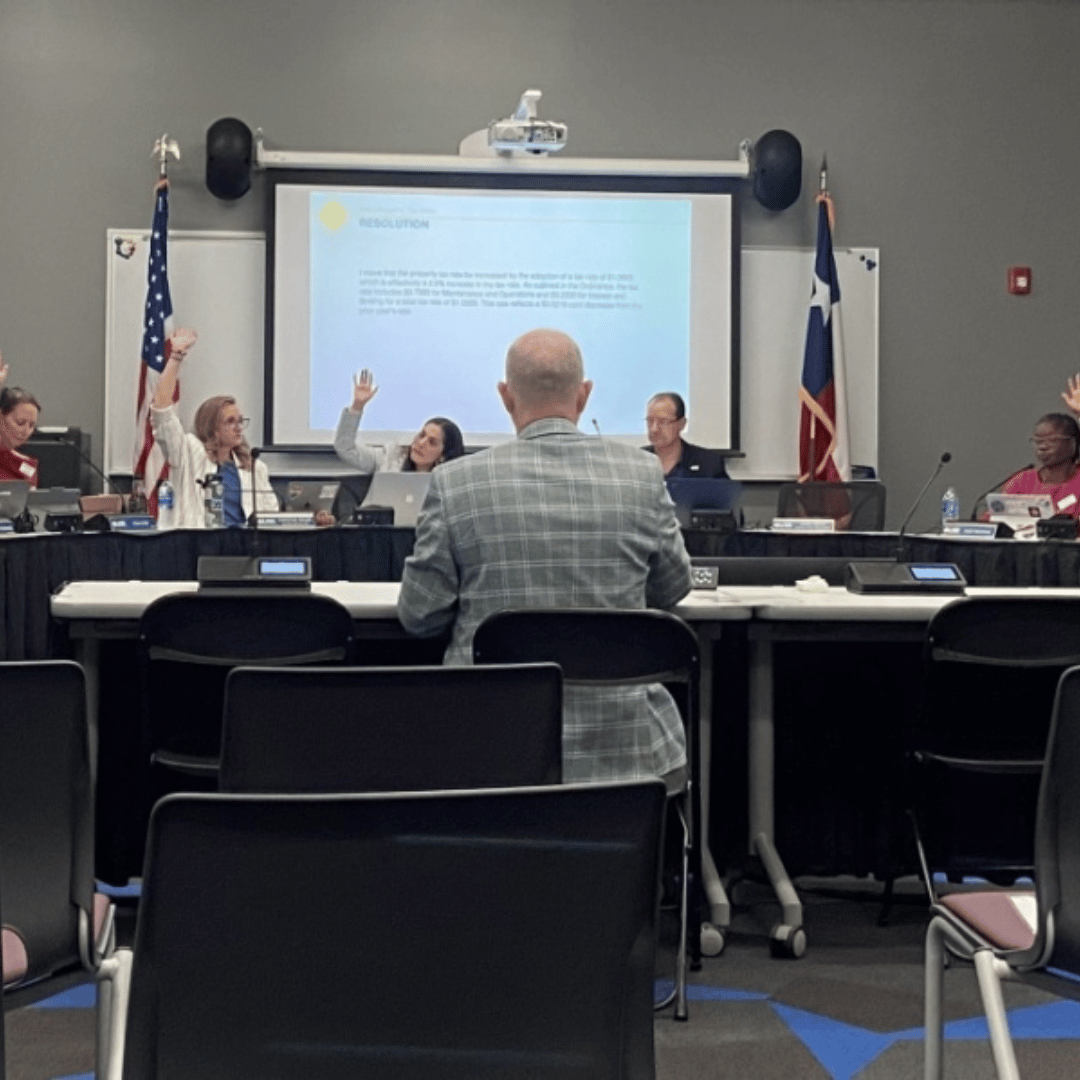

In a move that promises to offer some relief to local homeowners, the Leander Independent School District (Leander ISD) has approved a reduced property tax rate for the fiscal year 2024-25. This decision, finalized on August 23, 2024, reflects the district’s commitment to balancing its financial needs with the economic realities facing its residents.

The New Tax Rate

The newly adopted tax rate is set at $1.2746 per $100 of property valuation, which marks a decrease from the previous year’s rate. This reduction is particularly significant as it comes at a time when many homeowners are feeling the pinch of rising property values and the accompanying tax burdens. The new rate is composed of two main components: the Maintenance and Operations (M&O) rate, which funds day-to-day operations, and the Interest and Sinking (I&S) rate, which covers debt service.

Impact on Homeowners

For homeowners within the Leander ISD boundaries, this reduction could mean a lower tax bill, depending on how property values have shifted. It’s important to note that while the tax rate has been lowered, actual savings will vary depending on individual property assessments. For those who have seen their property values increase significantly, the lower rate may help offset some of the tax impact but may not completely neutralize it.

Why the Reduction?

The decision to lower the tax rate comes as Leander ISD faces a challenging fiscal environment. The district has worked to cut costs and optimize resources to ensure that it can continue to provide quality education while remaining financially sustainable. The reduction also reflects an acknowledgment of the burden that high property taxes can place on homeowners, especially in an area where property values have been rising steadily.

Looking Ahead

While the lower tax rate is welcome news for many, it also comes with the responsibility of ensuring that the district continues to meet the needs of its growing student population. Leander ISD will need to navigate these financial waters carefully, balancing the desire to ease tax burdens with the necessity of maintaining high educational standards.

For current and prospective homeowners in the Leander ISD area, this tax rate reduction is a positive development. It not only highlights the district’s responsiveness to community concerns but also reinforces the area’s appeal as a desirable place to live. As always, staying informed about local tax policies and how they impact your finances is crucial for making the most of your investment in the Leander community.

If you’re considering buying or selling a home in the Leander ISD area, understanding how this tax change affects your situation can help you make informed decisions. Feel free to reach out to The Cummings Team® today for personalized advice on navigating the local real estate market in light of this recent update.

Image credit to Community Impact.